| Federal Tax Rates for Tax Year: 2013 | ||||||||

| Filing Status: Single | ||||||||

| Taxable Income Range: | Times | % | Minus | Equals | Tax | |||

| 0 to 8925 | X | 10 | Minus | 0 | Equals | Tax | ||

| 8926 to 36250 | X | 15 | Minus | 446.25 | Equals | Tax | ||

| 36251 to 87850 | X | 25 | Minus | 4071.25 | Equals | Tax | ||

| 87851 to 183250 | X | 28 | Minus | 6706.75 | Equals | Tax | ||

| 183251 to 398350 | X | 33 | Minus | 15869.25 | Equals | Tax | ||

| 398351 to 400000 | X | 35 | Minus | 28836.25 | Equals | Tax | ||

| 400001 and Up | X | 39.6 | Minus | 42236.25 | Equals | Tax | ||

| Federal Tax Rates for Tax Year: 2013 | ||||||||

| Filing Status: Married Filing Joint or Qualifying Widower | ||||||||

| Taxable Income Range: | Times | % | Minus | Equals | Tax | |||

| 0 to 17850 | X | 10 | Minus | 0 | Equals | Tax | ||

| 17851 to 72500 | X | 15 | Minus | 892.5 | Equals | Tax | ||

| 72501 to 146400 | X | 25 | Minus | 8142.5 | Equals | Tax | ||

| 146401 to 223050 | X | 28 | Minus | 12534.5 | Equals | Tax | ||

| 223051 to 398350 | X | 33 | Minus | 23687 | Equals | Tax | ||

| 398351 to 450000 | X | 35 | Minus | 31654 | Equals | Tax | ||

| 450001 and Up | X | 39.6 | Minus | 52354 | Equals | Tax | ||

| Federal Tax Rates for Tax Year: 2013 | ||||||||

| Filing Status: Married Filing Separate | ||||||||

| Taxable Income Range: | Times | % | Minus | Equals | Tax | |||

| 0 to 8925 | X | 10 | Minus | 0 | Equals | Tax | ||

| 8926 to 36250 | X | 15 | Minus | 446.25 | Equals | Tax | ||

| 36251 to 73200 | X | 25 | Minus | 4071.25 | Equals | Tax | ||

| 73201 to 111525 | X | 28 | Minus | 6267.25 | Equals | Tax | ||

| 111526 to 199175 | X | 33 | Minus | 11843.5 | Equals | Tax | ||

| 199176 to 225000 | X | 35 | Minus | 15827 | Equals | Tax | ||

| 225001 and Up | X | 39.6 | Minus | 26177 | Equals | Tax | ||

| Federal Tax Rates for Tax Year: 2013 | ||||||||

| Filing Status: Head of Household | ||||||||

| Taxable Income Range: | Times | % | Minus | Equals | Tax | |||

| 0 to 12750 | X | 10 | Minus | 0 | Equals | Tax | ||

| 12751 to 48600 | X | 15 | Minus | 637.5 | Equals | Tax | ||

| 48601 to 125450 | X | 25 | Minus | 5497.5 | Equals | Tax | ||

| 125451 to 203150 | X | 28 | Minus | 9261 | Equals | Tax | ||

| 203151 to 398350 | X | 33 | Minus | 19418.5 | Equals | Tax | ||

| 398351 to 425000 | X | 35 | Minus | 27385.5 | Equals | Tax | ||

| 425001 and Up | X | 39.6 | Minus | 46935.5 | Equals | Tax | ||

| [bigContact phones=on emails=on] | ||||||||

Daily Archives: 01/23/2013

Tax Rates – 2013 Returns

Tax Rates- 2012 Returns

| Federal Tax Rates for Tax Year: 2012 | ||||||||

| Filing Status: Single | ||||||||

| Taxable Income Range: | Times | % | Minus | Equals | Tax | |||

| 0 to 8700 | X | 10 | Minus | 0 | Equals | Tax | ||

| 8701 to 35350 | X | 15 | Minus | 435 | Equals | Tax | ||

| 35351 to 85650 | X | 25 | Minus | 3970 | Equals | Tax | ||

| 85651 to 178650 | X | 28 | Minus | 6539.5 | Equals | Tax | ||

| 178651 to 388350 | X | 33 | Minus | 15472 | Equals | Tax | ||

| 388351 and Up | X | 35 | Minus | 23239 | Equals | Tax | ||

| Filing Status: Married Filing Joint or Qualifying Widower | ||||||||

| Taxable Income Range: | Times | % | Minus | Equals | Tax | |||

| 0 to 17400 | X | 10 | Minus | 0 | Equals | Tax | ||

| 17401 to 70700 | X | 15 | Minus | 870 | Equals | Tax | ||

| 70701 to 142700 | X | 25 | Minus | 7940 | Equals | Tax | ||

| 142701 to 217450 | X | 28 | Minus | 12221 | Equals | Tax | ||

| 217451 to 388350 | X | 33 | Minus | 23093.5 | Equals | Tax | ||

| 388351 and Up | X | 35 | Minus | 30860.5 | Equals | Tax | ||

| Filing Status:Married Filing Separate | ||||||||

| Taxable Income Range: | Times | % | Minus | Equals | Tax | |||

| 0 to 8700 | X | 10 | Minus | 0 | Equals | Tax | ||

| 8701 to 35350 | X | 15 | Minus | 435 | Equals | Tax | ||

| 35351 to 71350 | X | 25 | Minus | 3970 | Equals | Tax | ||

| 71351 to 108725 | X | 28 | Minus | 6110.5 | Equals | Tax | ||

| 108726 to 194175 | X | 33 | Minus | 11546.75 | Equals | Tax | ||

| 194176 and Up | X | 35 | Minus | 15430.25 | Equals | Tax | ||

| Filing Status:Head of Household | ||||||||

| Taxable Income Range: | Times | % | Minus | Equals | Tax | |||

| 0 to 12400 | X | 10 | Minus | 0 | Equals | Tax | ||

| 12401 to 47350 | X | 15 | Minus | 620 | Equals | Tax | ||

| 47351 to 122300 | X | 25 | Minus | 5355 | Equals | Tax | ||

| 122301 to 198050 | X | 28 | Minus | 9024 | Equals | Tax | ||

| 198051 to 388350 | X | 33 | Minus | 18926.5 | Equals | Tax | ||

| 388351 and Up | X | 35 | Minus | 26693.5 | Equals | Tax | ||

| [bigContact phones=on emails=on] | ||||||||

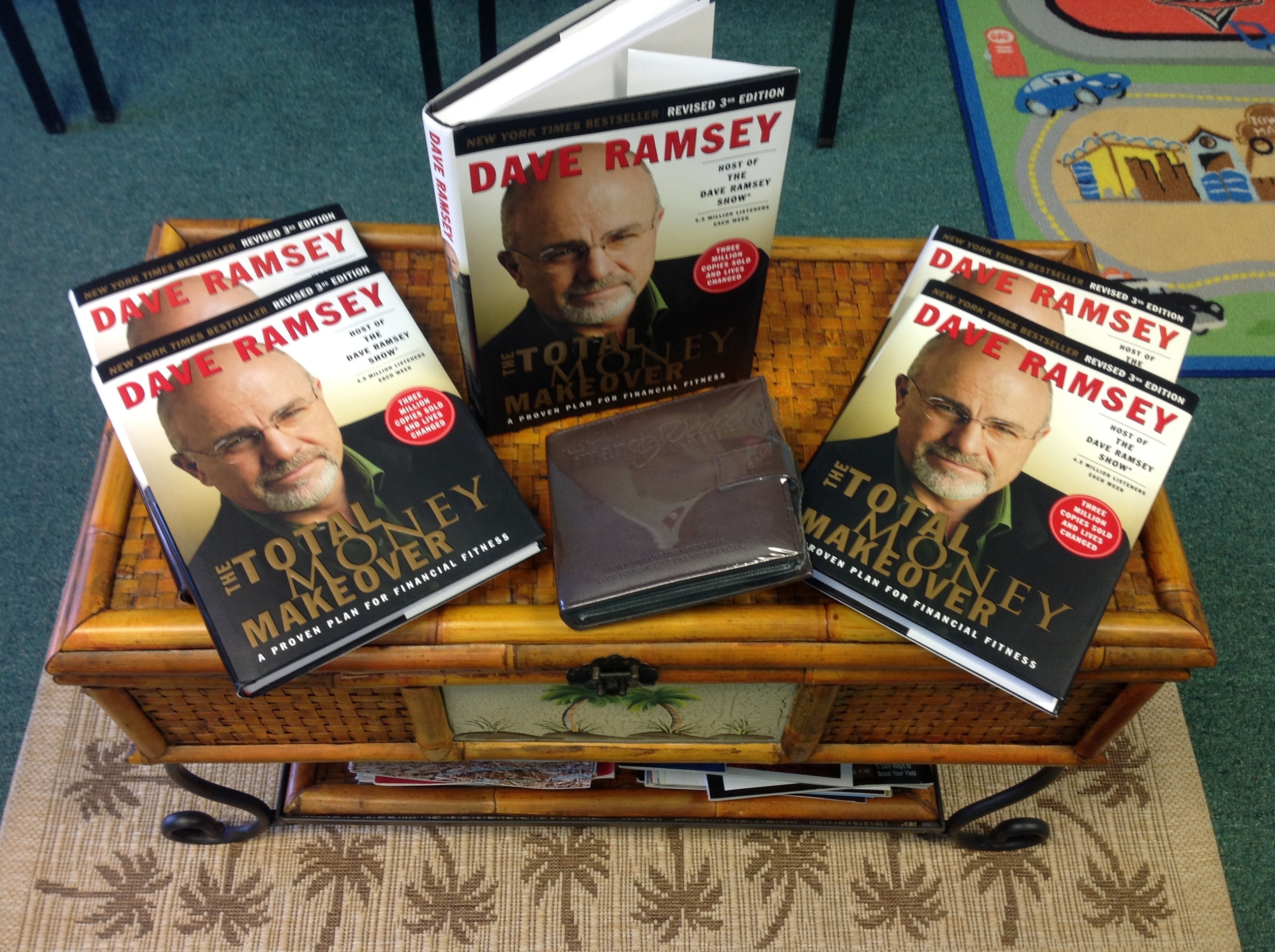

Heather Worrell Celebrates 25 Years in the Tax Industry with a Dave Ramsey Give A Way!

Heather Worrell, Enrolled Agent and owner of A Tax Haven, celebrates 25 years this January in the tax industry. She is also an Endorsed Local Tax Provider (ELP) for Dave Ramsey! In recognition of this special anniversary, A Tax Haven will be offering a Dave Ramsey Give A Way (Several Dave Ramsey Total Money Makeover Books & a set of Financial Peace University CDs) to help others learn more about handling their finances and budgeting. Current clients will be automatically entered into the drawing. All others need to fill out the contact form on this site to be entered in the drawing. Feel free to leave a respectful comment with a finance tip below. Send your friends to this blog at ataxhaven.org for their chance to win! Drawing will be held March 29th.

And as Dave Ramsey always says, “If you live like no one else, later you can live like no one else.”

CONGRATULATIONS to our Dave Ramsey Give A Way Winners at A Tax Haven- March 2013:

Megan Ladd

Kenneth & Corita Meredith

George Soper

Phyllis Gardner

Josephine Nash

Jimmy & Derlene Montgomery