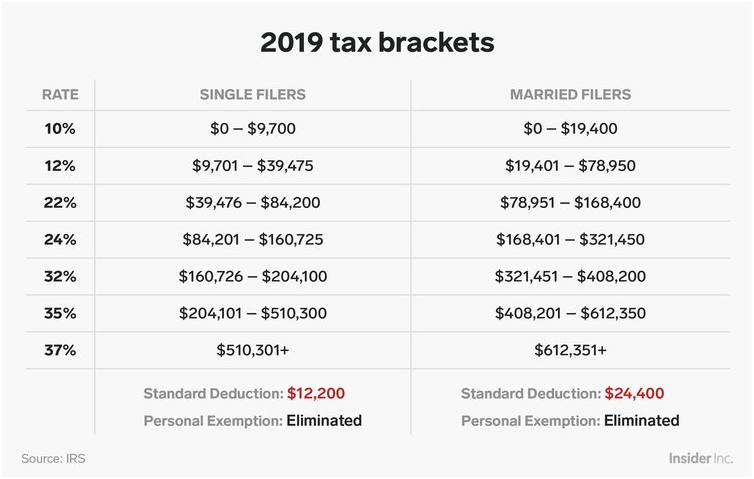

2022 tax brackets

REMINDER: Put all your tax documents into your green A Tax Haven bag as they come in the mail!

***There have been multiple changes for the 2021 filing season:

including additional pages of tax forms, extending some credits and rules while removing many others, as well as the addition of several new rules and credits just for the 2021 filing season!

You may now qualify for some credits that you may not have qualified for in the past!

Here are some tax reform laws to be aware of and some strategies to use by the end of the year:

(for taxes due in April 2020, or in October 2020 with an extension)

| Tax rate | Single | Married, filing jointly | Married, filing separately | Head of household |

|---|---|---|---|---|

| 10% | $0 to $9,700 | $0 to $19,400 | $0 to $9,700 | $0 to $13,850 |

| 12% | $9,701 to $39,475 | $19,401 to $78,950 | $9,701 to $39,475 | $13,851 to $52,850 |

| 22% | $39,476 to $84,200 | $78,951 to $168,400 | $39,476 to $84,200 | $52,851 to $84,200 |

| 24% | $84,201 to $160,725 | $168,401 to $321,450 | $84,201 to $160,725 | $84,201 to $160,700 |

| 32% | $160,726 to $204,100 | $321,451 to $408,200 | $160,726 to $204,100 | $160,701 to $204,100 |

| 35% | $204,101 to $510,300 | $408,201 to $612,350 | $204,101 to $306,175 | $204,101 to $510,300 |

| 37% | $510,301 or more | $612,351 or more | $306,176 or more | $510,301 or more |

The IRS has announced that they will begin accepting and processing all 2019 individual tax returns on Monday, January 27, 2020. A Tax Haven can still prepare returns as soon as taxpayers receive their current tax documents, and the returns will be transmitted and held until the IRS begins accepting them. Taxpayers do need to make sure they have received all of their relevant tax documents before filing—- W2s (even for a short-term job), 1099s, Mortgage Interest, 1095A for Marketplace Health Insurance, Stock Sales, Education Forms/ 1098Ts, Interest and Dividends Earned, etc.

When the IRS starts processing returns, acknowledgments may be unpredictable due to the high volume of returns being processed. Those with the Earned Income Tax Credit (EITC) or Child Tax Credit (CTC) are also likely to have their refunds delayed, since the IRS now gives extra attention to these credits. For e-filed returns with direct deposit (that do not have EITC or CTC or other specialty credits), it is estimated for the deposits to be 7-14 days from the day the return is accepted by the IRS.

Taxpayers can use the “Where’s My Refund?” tool on the IRS website (irs.gov) to keep an eye on their anticipated refund once they have filed their returns!

Own A Small Business? Here’s What You Need to Know

Running your own business can be time-consuming and stressful — don’t let bookkeeping and accounting tasks make it more so!

Know What You’re Talking About

Here are some common, but important terms that you may not be familiar with:

Sale Money In – This is a transaction you receive payment for.

Expense Money Out – This is something you pay for like rent or business supplies.

Liability This is something you owe money on that your company owns (computer, printer, etc.)

Revenue Revenue is income from sales. Deducting expenses from revenue tells you the profit.

Account Receivable Money that your customers owe based on invoices you send out.

Prepare to Create Your Business Plan and Allocate Funds with These Documents:

Balance Sheet

This shows your assets, liabilities, and owner’s equity. Equity is the value of business assets less the liabilities. In short, it tells you how much your company is worth.

Profit and Loss Statement

A profit and loss statement is usually completed quarterly. It gives you a quick summary of your profits (or losses) for a particular time period. This tells you if your business is profitable and by how much.

Cash Flow Statement

Your cash flow is divided into categories based on operating expenses, investments into business assets, and personal investments/borrowed money to fund your business.

Don’t Mix Business and Pleasure

It’s cliché, but extremely important in owning your own business. Start by setting up a bank account specifically for your company. Keep it (and any business related transactions) 100% separate from your personal accounts.

Every Penny Counts

Track every single expense! This is very important to monitor profit and loss, as well as keeping things simple for tax purposes. This means keeping receipts from all purchases and goes hand in hand with having a separate bank account for your company.

Two Copies are Better Than None

If you’ve ever found yourself searching desperately for a misplaced document, you’ll understand the importance of this tip. Scanning and saving to a digital record is the easiest way to ensure you always have a copy that is accessible when you need it.

Be sure to include Bank and Credit Card Statements, Cancelled Checks, Receipts (for sales and expenses), Bills, Customer Invoices and Payments, Deposit Slips, Tax Returns, Payroll Documentation (including 1099 and W2 forms).

You can choose to hand file these documents, but keep in mind that receipts and other documents may fade over time, making them impossible to read!

Stay Up To Date on All Cash Flow

Just because you sent an invoice doesn’t mean you were paid. By keeping accurate records, you can quickly catch any unpaid invoices to make sure your expenses are covered – and your services weren’t just given away!

Be Prepared

While you can’t predict the future, you can prepare for unexpected expenses or periods of lesser profit. Just as you should have a separate bank account for your business, you should also have a separate emergency fund. It should contain enough cash to cover your expenses for a minimum of three months, although six is preferable.

As much as possible, pay your expenses with cash (or debit). You may have less to take home in the beginning, but operating debt free will ultimately leave you with less risk and more profit. Avoid using credit cards or business loans when not absolutely necessary.

Plan Ahead for Tax Time

All of the previous tips help you achieve this goal – don’t be caught by surprise when you file your small business taxes.

Income Tax: These returns are based on your business structure, whether a sole proprietorship, an LLC, or a C/S Corporation. Check with a tax professional to see how your business structure will affect how you file.

Payroll Tax: You must also file payroll tax returns if you have employees. You must deposit these funds monthly and report quarterly. You’ll need a Federal Employer Identification Number, as well as a State Identification Number for each state where your business operates.

Sales Tax: This is another area where it can get tricky. You need to collect sales tax from each customer if you sell products. However, this varies by state, county, and city – even more so if you operate more than one location or sell items online.

A Professional Can Be a Valuable Resource

Small errors can be easily overlooked by an inexperienced person – and those errors can be costly. Even if only on a temporary or periodic basis, it is very helpful to have an experienced professional on your side, particularly someone who keeps up to date on the ever-changing tax laws.

Heather Worrell, of A Tax Haven, has decades of experience in business tax preparation and planning, as well as bookkeeping. She is an Enrolled Agent, which requires a comprehensive exam covering individual and business tax laws, as well as continuing education requirements. This also allows her to represent a client before the IRS in audits.

Call for an appointment today at 501-262-1040.

What You Need to Know About the New Tax Laws

Here are some strategies to use by the end of the year so that you can use the tax reform laws to your advantage.

These following apply to deductions that have been eliminated.

The Federal income tax has 7 rates: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. The amount of tax you owe depends on your income level and filing status.

NOTE: There are no personal exemption amounts for 2018.

The standard deduction is subtracted from your Adjusted Gross Income (AGI), which means it reduces your taxable income. (Note that there is an additional standard deduction for elderly and blind taxpayers, which is $1,300 for tax year 2018. This amount increases to $1,600 if the taxpayer is also unmarried.)

For tax year 2018, the standard deduction amounts are as follows:

Filing Status Standard Deduction

Single $12,000

Married Filing Jointly or Qualifying Widow(er) $24,000

Married Filing Separately $12,000

Head of Household $18,000

The 2018 tax rates are new take effect under the Tax Jobs and Cuts Act of 2017, which was signed into law by President Trump on December 22, 2017. These tax changes are effective as of January 1, 2018. While there are still 7 tax brackets, the rates have decreased overall. (These lower tax rates will expire in 2025, unless Congress votes to extend them.) The top rate is reduced from 39.6% to 37%. The bottom rate is still 10%, but it includes higher income.

Single

Taxable Income Tax Rate

$0 – $9,525 10% of taxable income

$9,526 – $38,700 $952.50 plus 12% of the amount over $9,525

$38,701 – $82,500 $4,453.50 plus 22% of the amount over $38,700

$82,501 – $157,500 $14,089.50 plus 24% of the amount over $82,500

$157,501 – $200,000 $32,089.50 plus 32% of the amount over $157,500

$200,001 – $500,000 $45,689.50 plus 35% of the amount over $200,000

$500,001 or more $150,689.50 plus 37% of the amount over $500,000

Married Filing Jointly or Qualifying Widow(er)

Taxable Income Tax Rate

$0 – $19,050 10% of taxable income

$19,051 – $77,400 $1,905 plus 12% of the amount over $19,050

$77,401 – $165,000 $8,907 plus 22% of the amount over $77,400

$165,001 – $315,000 $28,179 plus 24% of the amount over $165,000

$315,001 – $400,000 $64,179 plus 32% of the amount over $315,000

$400,001 – $600,000 $91,379 plus 35% of the amount over $400,000

$600,001 or more $161,379 plus 37% of the amount over $600,000

Married Filing Separately

Taxable Income Tax Rate

$0 – $9,525 10% of taxable income

$9,526 – $38,700 $952.50 plus 12% of the amount over $9,525

$38,701 – $82,500 $4,453.50 plus 22% of the amount over $38,700

$82,501 – $157,500 $14,089.50 plus 24% of the amount over $82,500

$157,501 – $200,000 $32,089.50 plus 32% of the amount over $157,500

$200,001 – $300,000 $45,689.50 plus 35% of the amount over $200,000

$300,001 or more $80,689.50 plus 37% of the amount over $300,000

Head of Household

Taxable Income Tax Rate

$0 – $13,600 10% of taxable income

$13,601 – $51,800 $1,360 plus 12% of the amount over $13,600

$51,801 – $82,500 $5,944 plus 22% of the amount over $51,800

$82,501 – $157,500 $12,698 plus 24% of the amount over $82,500

$157,501 – $200,000 $30,698 plus 32% of the amount over $157,500

$200,001 – $500,000 $44,298 plus 35% of the amount over $200,000

$500,001 or more $149,298 plus 37% of the amount over $500,000