Tag Archives: Standard Deduction

2018 Tax Rates for Individual Income Tax (Returns Filed in 2019)

2018 Tax Rates for Individual Income Tax Returns (Filed in 2019)

The Federal income tax has 7 rates: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. The amount of tax you owe depends on your income level and filing status.

NOTE: There are no personal exemption amounts for 2018.

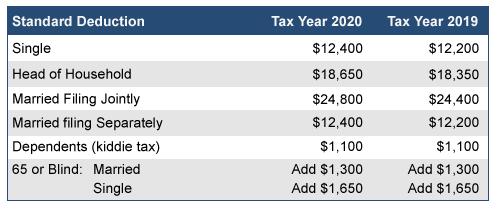

The standard deduction is subtracted from your Adjusted Gross Income (AGI), which means it reduces your taxable income. (Note that there is an additional standard deduction for elderly and blind taxpayers, which is $1,300 for tax year 2018. This amount increases to $1,600 if the taxpayer is also unmarried.)

For tax year 2018, the standard deduction amounts are as follows:

Filing Status Standard Deduction

Single $12,000

Married Filing Jointly or Qualifying Widow(er) $24,000

Married Filing Separately $12,000

Head of Household $18,000

The 2018 tax rates are new take effect under the Tax Jobs and Cuts Act of 2017, which was signed into law by President Trump on December 22, 2017. These tax changes are effective as of January 1, 2018. While there are still 7 tax brackets, the rates have decreased overall. (These lower tax rates will expire in 2025, unless Congress votes to extend them.) The top rate is reduced from 39.6% to 37%. The bottom rate is still 10%, but it includes higher income.

Single

Taxable Income Tax Rate

$0 – $9,525 10% of taxable income

$9,526 – $38,700 $952.50 plus 12% of the amount over $9,525

$38,701 – $82,500 $4,453.50 plus 22% of the amount over $38,700

$82,501 – $157,500 $14,089.50 plus 24% of the amount over $82,500

$157,501 – $200,000 $32,089.50 plus 32% of the amount over $157,500

$200,001 – $500,000 $45,689.50 plus 35% of the amount over $200,000

$500,001 or more $150,689.50 plus 37% of the amount over $500,000

Married Filing Jointly or Qualifying Widow(er)

Taxable Income Tax Rate

$0 – $19,050 10% of taxable income

$19,051 – $77,400 $1,905 plus 12% of the amount over $19,050

$77,401 – $165,000 $8,907 plus 22% of the amount over $77,400

$165,001 – $315,000 $28,179 plus 24% of the amount over $165,000

$315,001 – $400,000 $64,179 plus 32% of the amount over $315,000

$400,001 – $600,000 $91,379 plus 35% of the amount over $400,000

$600,001 or more $161,379 plus 37% of the amount over $600,000

Married Filing Separately

Taxable Income Tax Rate

$0 – $9,525 10% of taxable income

$9,526 – $38,700 $952.50 plus 12% of the amount over $9,525

$38,701 – $82,500 $4,453.50 plus 22% of the amount over $38,700

$82,501 – $157,500 $14,089.50 plus 24% of the amount over $82,500

$157,501 – $200,000 $32,089.50 plus 32% of the amount over $157,500

$200,001 – $300,000 $45,689.50 plus 35% of the amount over $200,000

$300,001 or more $80,689.50 plus 37% of the amount over $300,000

Head of Household

Taxable Income Tax Rate

$0 – $13,600 10% of taxable income

$13,601 – $51,800 $1,360 plus 12% of the amount over $13,600

$51,801 – $82,500 $5,944 plus 22% of the amount over $51,800

$82,501 – $157,500 $12,698 plus 24% of the amount over $82,500

$157,501 – $200,000 $30,698 plus 32% of the amount over $157,500

$200,001 – $500,000 $44,298 plus 35% of the amount over $200,000

$500,001 or more $149,298 plus 37% of the amount over $500,000

Tax Rates & Deductions- 2015 Returns

TAX RATES & DEDUCTIONS FOR 2015 TAX RETURNS/ FILED IN 2016:

TAX RATES:

SINGLE: TAXABLE INCOME

0 to 9225 X 10% Minus 0.00 Equals TAX

9226 to 37450 X 15% Minus 461.25 Equals TAX

37451 to 90750 X 25% Minus 4206.25 Equals TAX

90751 to 189300 X 28% Minus 6928.75 Equals TAX

189301 to 411500 X 33% Minus 16393.75 Equals TAX

411501 to 413200 X 35% Minus 24623.75 Equals TAX

413201 and up X 39.60% Minus 43630.95 Equals TAX

MFJ/QW:TAXABLE INCOME

0 to 18450 X 10% Minus 0.00 Equals TAX

18451 to 74900 X 15% Minus 922.50 Equals TAX

74901 to 151200 X 25% Minus 8412.50 Equals TAX

151201 to 230450 X 28% Minus 12948.50 Equals TAX

230451 to 411500 X 33% Minus 24471.50 Equals TAX

411501 to 464850 X 35% Minus 32701.00 Equals TAX

464851 and up X 39.60% Minus 54084.10 Equals TAX

HOH: TAXABLE INCOME

0 to 13150 X 10% Minus 0.00 Equals TAX

13151 to 50200 X 15% Minus 657.50 Equals TAX

50201 to 129600 X 25% Minus 5677.50 Equals TAX

129601 to 209850 X 28% Minus 9565.50 Equals TAX

209851 to 411500 X 33% Minus 20058.00 Equals TAX

411501 to 439000 X 35% Minus 28288.00 Equals TAX

439001 and up X 39.60% Minus 48482.00 Equals TAX

MFS: TAXABLE INCOME

0 to 9225 X 10% Minus 0.00 Equals TAX

9226 to 37450 X 15% Minus 461.25 Equals TAX

37451 to 75600 X 25% Minus 4206.25 Equals TAX

75601 to 115225 X 28% Minus 6474.25 Equals TAX

115226 to 205750 X 33% Minus 12235.50 Equals TAX

205751 to 232425 X 35% Minus 16350.50 Equals TAX

232426 and up X 39.60% Minus 27042.05 Equals TAX

STANDARD DEDUCTIONS:

SINGLE/MFS 6300

MFJ/QW 12600

HOH 9250

Additional added if 65 or older or blind/per person, per event:

MFJ/QW/MFS plus 1250

S/HOH plus 1550

PERSONAL EXEMPTIONS: 4000 Per Person

STANDARD MILEAGE RATES:

BUSINESS 57.5 Cents per Mile

CHARITABLE 14 Cents per Mile

MEDICAL 23 Cents per Mile

MOVING 23 Cents per Mile

EIC MAXIMUM INCOME LIMITS:

CHILDREN: NONE 1 2 3

MFJ 20330 44651 49974 53267

S/HOH/QW 14820 39131 44454 47747

A TAX HAVEN 501-262-1040 ataxhaven.com